Giving from Your 401k or IRA Retirement Plan

Leave family the balance of savings and checking accounts, and donate double-taxed assets like IRAs to us.

You've worked hard and planned for retirement. Now, with a little creativity, you can leverage your retirement assets to benefit you and your family, reduce federal taxes, and support Holton-Arms far into the future.

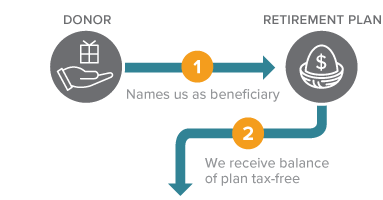

How It Works

- Name The Holton-Arms School as a beneficiary of your IRA, 401(k), or other qualified retirement plan.

- Pass the balance of your retirement assets to Holton-Arms by contacting your plan administrator.

- Important! Tell Holton-Arms about your gift. Your plan administrator is not obligated to notify us, so if you don't tell us, we may not know.

Benefits

- Continue to take regular lifetime withdrawals.

- Maintain flexibility to change beneficiaries if your family's needs change during your lifetime.

- Your heirs avoid the potential double taxation on the assets left in your retirement account.

Next

- More detail on retirement plans.

- Frequently asked questions on retirement plans.

- Contact us so we can assist you through every step.